IT infrastructure is threaded throughout every part of enterprise operations and strategy. Today, it’s just as important to the success of a merger as financials, business processes, and company culture. In fact, failure to successfully integrate IT systems can have a serious negative impact on the ROI of mergers and acquisitions.

To smooth the path toward integration, optimize costs, and speed up the time to completion of your merger, you need a complete plan—an M&A IT integration program—that outlines how you’ll effectively combine IT assets from both companies.

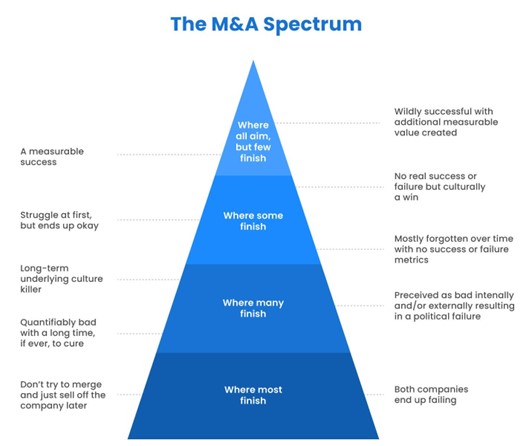

Doing so increases the likelihood that you’ll execute your merger or acquisition without incident and extract the most possible value from your deal. To put it in more visual terms, you’ll reach the top of the post-merger success pyramid—a place every company aims to be but few are able to reach.

In this comprehensive guide, we’ll cover everything you need to know about launching a successful IT integration strategy, including steps to prepare, an M&A IT integration program checklist, and integration management best practices to prioritize as you execute.

Quick Takeaways

- Launching a successful M&A IT integration program begins with planning—including a current state inventory, readiness assessment, and documented execution plan.

- Systems and data compatibility must be top of mind at the start of any IT integration. Proactive strategies to handle incompatibilities should be developed before the execution stage.

- A successful M&A integration strategy requires thinking beyond the technical and implementing change management around people, processes, and culture.

- Cybersecurity risks are elevated during IT mergers. M&A IT integration programs must include a solid cybersecurity strategy for both during and after the transition.

- Many companies choose to partner with a third-party IT integration services provider that can guide them through the process and provide expertise throughout.

Preparing for an M&A IT Integration

The first mistake many organizations make is trying to dive head-first into IT integration without taking the right steps to prepare. Successful integration requires a bit of a methodical approach, first understanding your current state of technology affairs before you actually move on to the execution phase.

1. Collect relevant information

While cloud adoption is fast on the rise, most enterprises still have leftover legacy systems still active in their IT infrastructures. At the same time, the use of software tools is on the rise (for large companies, they can number in the thousands) and the likelihood of redundancy is nearly inevitable when organizations merge.

To combat these challenges from the start and position your M&A IT integration program for success, start by performing a complete current state architecture inventory that details and categorizes every asset from all organizations involved in the merge.

While the process might sound painstaking, there are platform tools (like Protera) designed to automate these steps and support it with data-driven reporting capabilities (think application landscape reports, business capability maps, and the like).

The result is full transparency and visibility for all teams involved, and a complete grasp on what your IT integration process will entail. You’ll be able to address potential challenges proactively and make decisions using fully-informed insights. Perhaps most importantly, you’ll have objective data to lean on during what can be a (relatively) emotional decision-making process.

2. Establish Governance and Communication Channels

Set up a governance structure that establishes clear roles and responsibilities related to your M&A integration strategy. Define who will make final decisions and how information will be communicated to both internal and external stakeholders.

Effective communication channels are vital to ensure transparency and facilitate quick resolution of issues as they arise.

3. Perform Readiness Assessments

Many companies choose to use M&A IT integrations as an opportunity to modernize infrastructures and move to the cloud. The complicating factor is that you’re dealing with multiple IT infrastructures that are likely at different stages of readiness.

For any planned cloud modernization or migration, you need to first understand how your current state translates to readiness for more transformative initiatives. Similarly to the current state inventory process, you can use automated software tools (like Protera CloudVantage) to perform a detailed self assessment and make next-step decisions using objective results.

4. Develop a Data Management Strategy

Data is often the lifeblood of an organization, and its management is a critical component of a successful IT integration strategy for mergers. Develop a clear plan that outlines how data will be handled, ensuring compliance with data privacy laws and regulations. This strategy should cover data mapping, migration, quality checks, standardization, access, and future data governance.

5. Create an Execution Plan

Successful IT integration hinges on thorough planning. In many cases, a phased approach is needed to minimize risk and business disruption. To manage and keep track of it all, you’ll need an actual documented plan. A visual version of your plan is most effective—one that can be viewed in real-time and shared with everyone involved in the integration process.

At Protera, we use roadmaps to visualize and track progress toward M&A IT integration goals. A roadmap both encompasses the entire process from start to finish, but also translates the many moving parts of an integration into a single-view document that everyone can understand.

6. Conduct a Risk Assessment

Before you launch the execution phase of your integration strategy, analyze potential risks associated with merging IT systems, including cybersecurity threats, system compatibility issues, and data loss risks. This is best done via a comprehensive, documented risk assessment.

Performing an organization-wide risk assessment helps to ensure integration strategies are proactively designed with risk reduction in mind. It also informs the development of effective mitigation strategies to protect IT assets during and after the integration occurs.

7. Plan for Scalability and Flexibility

Both technology and organizational IT needs continually evolve and change. As such, it’s important to look beyond the immediate integration needs and plan for future growth and potential pivots in strategy. Ensure that all M&A integrated solutions and your overall IT infrastructure are scalable and flexible enough to support evolving business requirements and technological advancements.

8. Establish Unified Communication Platforms

Communication is key in M&A integration, not just for the IT teams but for the entire organization. Establish a unified communication platform early in the integration to ensure that all stakeholders have access to consistent messaging, updates, and can collaborate effectively.

9. Evaluate and Prioritize IT Projects

Post-merger, there will likely be an array of concurrent IT projects vying for attention. Evaluate all projects in the pipeline from all entities, and prioritize them based on their strategic importance, impact on integration, and the value they add to the merged company.

As you did with the actual integration, make a clear execution plan (with timelines) for taking these on.

Doing so positions your IT team and your integration program to be ready to hit the ground running once the integration is complete, without being delayed by the need to evaluate competing priorities later.

Key Stages of Integration Execution

After your planning process comes time to actually execute—but where do you start? What should the order of events be for a real-world M&A integration program? Let’s look at 5 stages of execution that can guide you in your planning.

1. Merge Technical Systems

Use your planning reports and execution roadmap to begin actual integration. Test frequently during this process to address issues that arise before they become problems. Maintain full visibility with a software tool that provides real-time views into your IT integration progress.

2. Perform Data Integrations and Migrations

Data integration and potential cloud migration are two of the most sensitive steps in your M&A IT integration program. You’ll need to find ways to execute and optimize while also adhering to security and compliance standards. Include a detailed data integration and/or migration roadmap within your larger integration roadmap, one that’s specific to data-related needs.

3. Tech Stack Rationalization

This likely happened to some extent during your planning process, but you may be surprised at new insights you uncover (and new redundancies that may appear) as you actually begin to execute. Along with frequent testing, continue to rationalize your tech stack and make smart decisions about what to keep vs. eliminate.

4. Continual Optimization

Integrating IT systems is only the first step in the process toward full realization of M&A ROI potential. As you integrate and after your initial IT merger is complete, continually look for ways to better align your IT assets and optimize for increased value.

5. Operations Continuity

Throughout the integration process, it is critical to maintain business continuity. Plan for parallel operations where new and old systems run concurrently to ensure that all business functions continue uninterrupted. Implement failovers and backup systems to minimize disruptions and ensure that all teams understand their roles during the transition.

6. IT Support/Services Consolidation

Consolidating IT support and services is a crucial stage in the M&A IT integration process. This involves merging help desks, standardizing support procedures, and ensuring that employees from both original companies have equal access to IT support.

Aim to create a singular, efficient IT service and support structure that can handle the increased scope of the merged entity's operations.

7. Long-Term IT Improvement

A complete integration and optimization doesn’t happen overnight. Along the way, document long-term steps for improvement you may not be able to execute now, but will be important for the future. Once the initial integration is complete, revisit these projects as your team is able.

Common M&A Integration Challenges (and How to Mitigate)

Mergers are complex by nature. Having an M&A integration program designed to anticipate common challenges and mitigate risk throughout the process is the best way to ensure a smooth transition. Some of the most common challenges to consider are:

1. Systems Incompatibility

Whether it’s different platforms, outdated legacy systems, or contrasting data formats, incompatibility can significantly stall M&A integration processes. Be sure that your initial current state assessment includes a compatibility analysis to identify these disparities, then plan for how you’ll handle them. You may choose to use middleware when needed to bridge gaps, even if just temporarily.

Resolving incompatibility issues is one facet of an M&A integration that often extends beyond the technical. Business leaders and employees usually have preferences for certain systems and processes, and effective change management may be necessary to smooth this part of the transition.

2. Data Integration Issues

Merging data from different companies often leads to issues such as duplicate records, inconsistent data formats, and varying data quality standards. Your unified data governance framework should clarify how these issues will be handled before actual integration begins.

Utilize data deduplication tools, and standardize data management practices across both organizations early in the process. Implementing comprehensive data quality management processes will ensure that the combined entity has accurate, clean, and usable data.

3. Cybersecurity Threats

The merging of multiple IT infrastructures comes with an increased risk of cybersecurity threats. During integration, systems may be more vulnerable, especially as firewalls and other protective measures are adjusted.

To safeguard against potential threats, perform a full cybersecurity assessment and establish a unified security protocol during the transition. Strengthening cybersecurity defenses and ensuring continuous monitoring throughout the integration process are key to protecting critical assets.

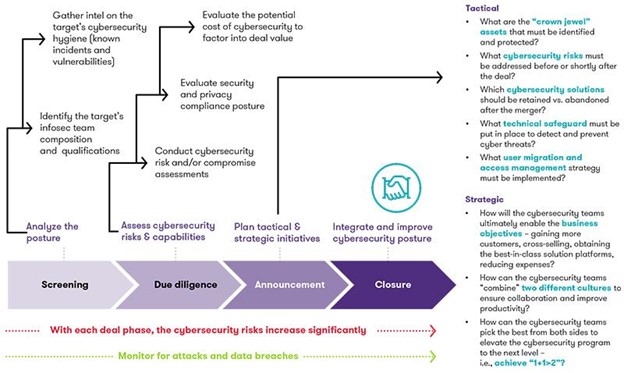

Grant Thornton provides an excellent cybersecurity playbook template for mergers and acquisitions that can serve as a resource as you develop your own unique version:

As you develop a long-term cybersecurity plan for the merged entity, consider a comprehensive security platform that can effectively monitor and protect all critical systems using a single, centralized interface.

4. Regulatory Compliance Challenges

M&A activities often involve navigating a complex web of regulatory compliance issues, which can become even more intricate when IT systems merge. To proactively address new compliance challenges, conduct a thorough review of regulatory requirements for all involved entities.

Develop a compliance checklist that guides the integration process, and ensure that all IT changes are documented and traceable to maintain compliance throughout the transition.

5. Cultural and Operational Misalignments

IT integration is not just about technology; it’s also about people and processes. Differences in corporate culture and operational practices can lead to resistance or misalignment, and even deal failure. Outside of integration and implementation issues, cultural integration issues are the top reason for deal failure in M&A, with 33% of deals

To minimize these challenges, involve representatives from all companies taking part in the IT integration process. Communication and change management initiatives should be employed to align teams, harmonize workflows, and foster a collaborative culture focused on shared success.

6. Resource Allocation Strains

The effort required to integrate IT systems can strain resources, leading to overextended teams and budget overruns. Anticipate resource needs by developing a detailed integration schedule that outlines all required actions and timelines

Allocating dedicated resources to your M&A IT integration program and considering the temporary use of external experts or managed integration services can help to alleviate the burden on internal teams.

By anticipating the above challenges and implementing strategies to address them, you’ll position your company to experience a smoother and more successful integration. Proactive planning, combined with agile problem-solving, will help ensure that integration efforts lead to a strong, unified IT infrastructure that supports your new entity's strategic goals.

Final Thoughts: Why You Should Work With an Expert

Even the smoothest mergers are complicated to execute. Company leadership has no shortage of priorities to focus on while combining teams, processes, and IT assets, while also providing continuity for customers and building a new, integrated culture.

At the same time, your M&A IT integration program requires full-time focus in order to avoid issues and ultimately be successful. Partnering with an expert service provider that can deliver complete integration services and guide you through the process is the smartest way to execute with confidence.

Third-party service providers have the tools, resources, and deep expertise you need to complete a successful post-merger integration. Further, working with an MSP allows you to more easily scale your efforts up and down as needed so that you can stay agile throughout the entire merger process.

Protera is a leading provider of enterprise application and cloud management services with a proven track record for successfully guiding clients through transformative times like mergers — all while minimizing risk, optimizing costs, and maximizing value at every stage.

Check out these real-world examples of Protera guiding clients through M&A IT integrations:

- K-SWISS Successfully Integrates Global Systems After Being Acquired

- Tidewater Creates Global SAP Platform in 9 Months after Merger with Gulfmark

- Altra Motion Scales with the Public Cloud After Acquisitions

Want to learn more about how we can help you transform through M&A? Contact our sales team today to learn more

.png)

Mergers & Acquisitions with SAP

In 2024, roughly 50,000 M&A deals were made worldwide, with a combined value of $3.2 trillion.